Navigating compliance in a call center environment is no easy task, especially when it comes to outbound sales or lead generation.

The Telephone Consumer Protection Act (TCPA), frequent updates from the Federal Communications Commission (FCC), and various state regulations can make it challenging to keep up with the latest requirements.

But by focusing on a few core principles, you can maintain compliance and avoid costly mistakes. This call center compliance checklist covers essential guidelines and best practices to help you ensure your team operates within the law, all while building trust with your customers.

What is Call Center Compliance?

At its most basic level, call center compliance means adhering to laws and regulations that control how call centers interact with customers.

At the federal level, the TCPA, together with the FCC’s implementing regulations and the Federal Trade Commission’s (FTC) Telemarketing Sales Rule (TSR), are some of the rules that are key to your compliance journey.

At the state level, the Texas Mini-TCPA, Oklahoma Telemarketing Sales Act (OTSA), Florida Telemarketing Sales Act (FTSA), and Maryland’s Stop the Spam Calls Act are some of the core rules for businesses calling residents in those states.

Anyone involved in managing or operating a call center should prioritize compliance, including owners, managers, compliance officers, and sales agents.

Even businesses using outsourced call centers, such as BPOs, need to follow the rules to safeguard their reputation and operations. Plus, regular monitoring of those who call on your behalf should be a recurring part of your compliance regime.

Why Does Call Center Compliance Matter?

The most obvious reason that call center compliance matters is that it helps you avoid violating applicable laws and regulations, which can lead to costly fines and lawsuits.

For example, you can be held liable under the TCPA for up to $500–$1,500 per call or text violation (and even higher in some states), regardless of whether the person you called incurred any actual damages.

Beyond that, call center compliance can serve to strengthen your brand. A company known for compliant practices is more likely to be trusted by consumers, leading to stronger customer relationships.

Compliant practices also ensure that you’re making calls that are worth making. By following best practices, you can avoid your outbound calls being flagged as spam—increasing the odds of terminating carriers delivering your call and your prospects actually answering your call.

Ultimately, staying compliant not only protects your business from legal penalties but also builds trust with customers by safeguarding their rights and information.

Things to Consider for Outbound Calling & TCPA Compliance

When trying to achieve call center compliance, it’s essential to ask the right questions and address key issues that can impact your ability to meet regulatory standards.

Where are you calling?

First, it is important to consider which states you are calling into. This determines which state laws you need to comply with, as regulations can and do vary from state to state.

For example, in Michigan, sales calls can be made from 9 a.m. to 9 p.m., Monday–Sunday. But in Louisiana, sales calls can only be made from 8 a.m. to 8 p.m., Monday–Saturday, and cannot be made on Sundays or holidays (of which there are many down there).

In Oregon, as of January 1, 2026, sales calls can only be made from 8 a.m. to 8 p.m., and only three (3) sales calls can be made to the same consumer within a 24-hour period.

Knowing which states you are calling into is especially important if you are recording your calls. There are over 10 states that require “two-party consent,” which means that all parties to the call must consent to the call being recorded.

What technology are you using to make calls?

Another important consideration is what technology you are using to make calls and how you’re using it. The TCPA, under Section 227(b), regulates calls made with an automatic telephone dialing system (ATDS) and calls made with an artificial or prerecorded voice.

Various state laws regulate so-called autodialers or ADADs, which have their own definitions that do not necessarily overlap with the TCPA’s ATDS definition.

Telemarketing calls made with an ATDS or prerecorded/artificial voice are subject to heightened, written consent requirements under the TCPA. Further, prerecorded or artificial voice (including AI) calls are subject to certain disclosure requirements.

If you send sales texts to consumers, you should be aware that whether there is a private right of action—a right to sue—under Subsections 227(b) and 227(c) of TCPA for the receipt of text messages is currently a hot topic.

In the wake of the Supreme Court’s rulings in Loper Bright and McLaughlin, some TCPA defendants have successfully argued that there is no such private right of action under Subsection 227(c) of the TCPA because the plain language of that subsection makes clear that it applies only to “telephone calls,” and a text messages is not a telephone call.

In Dilanyan v. Hugo Boss Fashions, Inc. the Central District of California certified that issue for an interlocutory appeal to the Ninth Circuit (Alaska, Arizona, California, Hawaii, Idaho, Montana, Nevada, Oregon, and Washington). Federal courts in Florida and Illinois have also ruled that a text message is not a “call” under the TCPA’s Do Not Call subsection (but other courts in those same states have also held the opposite, so it is early days in that legal area).

And again, there are state laws that also regulate certain calling technology. For example, under the FTSA, you must have prior express written consent to make a lawful unsolicited sales call to someone using an automated system or prerecorded message.

Are you making the type of calls that require consent?

As noted above, the TCPA requires express consent for calls made with an ATDS or prerecorded/artificial voice.

Before making a solicitation call, the TCPA also requires a caller to obtain the called party’s consent—or have an established business relationship with them—if their residential telephone number is registered on the National Do Not Call Registry.

Reminder: regulations may vary by state. Connecticut has enacted a law that requires callers to obtain a person’s prior express written consent before making sales calls to their cell phone.

Do you have a written do-not-call procedure in place?

The FCC’s TCPA-implementing regulations also require businesses making sales calls to honor consumers’ do-not-call requests made directly to the business. As of April 11, 2025, businesses must honor such requests within a reasonable time, not to exceed ten (10) business days.

As part of that requirement, businesses must maintain their own do-not-call list and have a written policy for maintaining that list. That written policy must be available to a consumer upon demand. This is a relatively simple but important step in achieving compliance.

Are you a telemarketer and/or operating a calling campaign that constitutes telemarketing under the TSR?

The Telemarketing Sales Rule (TSR) is a set of regulations enforced by the FTC that governs how telemarketers (e.g., sales agents, lead generators) operate and protects consumers from unwanted behavior. It is important to know whether the TSR is applicable to your business and/or call campaign(s).

Notably, the TSR contains several regulations requiring truthfulness when disclosing certain information and prohibits misrepresentations. The TSR also contains record-keeping rules that telemarketers must follow.

Are there industry-specific issues that apply to your call campaign(s)?

Depending on the subject of your calling campaigns, there may be applicable industry-specific rules. Here are some examples:

- The Health Insurance Portability and Accountability Act (HIPAA) contains regulations intended to ensure the protection of individuals’ health information. HIPAA is likely applicable to those involved in call campaigns concerning products related to healthcare, health insurance, and/or Medicare.

- The Gramm-Leach-Bliley Act (GLBA) applies to financial institutions and, subject to certain exceptions, prohibits them from sharing customer account numbers, access numbers, and/or access codes with non-affiliated third parties for telemarketing purposes.

- The Fair Debt Collection Practices Act (FDCPA) contains regulations that are applicable to call centers involved in debt collection. For example, one regulation prohibits you from making debt collection calls during inconvenient times of day.

Call Center Compliance: Quick Checklist

Now that we have explored the key regulations and considerations in detail, here’s a quick checklist to help you ensure your sales call center stays compliant with essential rules and best practices.

1. Identify Location-Specific Call Restrictions

- Research state laws to identify permitted calling hours, any holiday calling restrictions, and any limitations on the number of sales calls that can be made to a consumer within a certain period of time.

- Be aware of states with two-party consent laws for call recordings (over 10 states, including California and Florida).

- Verify if there are local regulations beyond state-level, such as in municipalities with additional restrictions on telemarketing.

2. Assess Technology Compliance

- Comply with the Telephone Consumer Protection Act (TCPA) for calls made using an automatic telephone dialing system (ATDS) or prerecorded/artificial voices. If you’re making sales or marketing calls, these types of calls typically require prior express written consent from the person you’re calling.

- Follow additional state laws, such as the Florida Telephone Solicitation Act (FTSA), which mandates express written consent before making unsolicited sales calls using an automated system or prerecorded message.

3. Obtain Necessary Consent

- Before making solicitation calls to numbers on the National Do Not Call Registry, ensure you have the recipient’s consent or an established business relationship.

- Follow state-specific rules, such as Connecticut’s law, which requires prior express written consent before making sales calls to cell phones.

4. Maintain Do-Not-Call Procedures

- Establish and maintain a written Do-Not-Call (DNC) policy as required by FCC regulations if you make sales calls. This policy must be available upon request.

- Maintain an internal do-not-call list for consumers who request not to be contacted and honor those requests as part of your compliance obligations.

- Honor all consumer do-not-call and do-not-text requests as soon as possible and by no later than ten (10) business days after receiving such requests.

5. Follow the Telemarketing Sales Rule (TSR)

- Ensure that your call center complies with the Telemarketing Sales Rule (TSR) if your calls are subject to the TSR. The TSR prohibits false or misleading statements in your solicitation calls and requires transparency in disclosing key information.

- Adhere to the TSR’s record-keeping requirements with respect to any telemarketing campaigns, which include maintaining records of customer transactions and telemarketing communications.

6. Address Industry-Specific Regulations

- If your campaign involves receiving or exchanging covered information for healthcare or health insurance, comply with the Health Insurance Portability and Accountability Act (HIPAA) to protect the privacy of individuals’ health information.

- If your campaign deals with financial services, ensure compliance with the Gramm-Leach-Bliley Act (GLBA), which prohibits sharing certain customer data with third parties for telemarketing purposes.

- For debt collection campaigns, follow the Fair Debt Collection Practices Act (FDCPA), which includes requirements like avoiding calls during inconvenient times.

How Readymode Can Help You Stay Compliant

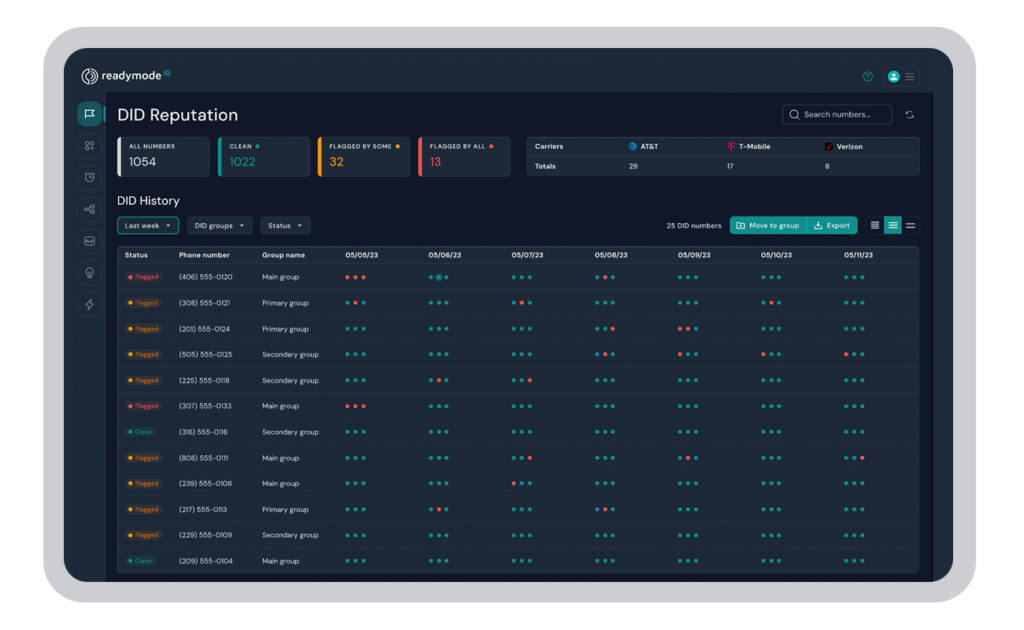

Readymode is a voice-first, outbound customer engagement platform that provides a variety of tools to help businesses achieve call center compliance. One valuable tool is Readymode’s simple do-not-call list management, which helps you avoid making calls to consumers that have opted out from receiving calls.

Readymode also has integrations with industry-leading vendors that provide tools to help you scrub and manage your lead lists, such as scrubbing against the National Do Not Call Registry and so-called litigator scrubs.

Efficiently following rules and regulations while protecting your business is now easier than ever. Book a demo today and discover how Readymode can simplify compliance for your call center.

This article is only offered for informational purposes, not as legal advice. Please always consult a qualified attorney to address your compliance needs.

Joe Bowser

Joe Bowser is a partner at Roth Jackson. He has been practicing communications and marketing law for two decades. He advises and defends calling and SMS platform providers (like Readymode), carriers/VoIP providers, and heavy users of those services in their wide range of compliance needs. In his spare time, you can find him taking his boys to their sports, getting in a workout of his own, or catching an Arsenal match.