Financial services teams operate in a tough spot. You’re expected to move fast, build trust on the first call, and stay within strict compliance boundaries—all at the same time.

Whether you’re working in lending, mortgages, insurance, or debt relief, outbound calling remains a core part of how you reach prospects and serve clients.

The challenge isn’t making more calls. It’s having better conversations without putting your brand or your team at risk. That’s where dialing software comes in. When used the right way, it helps you connect with the right people, at the right time, using processes built for real financial outreach.

In this article, we’ll break down the benefits of dialing software for financial services and explain why many financial teams trust Readymode.

TL;DR: Why Financial Services Teams Need Outbound Dialing Software

An outbound dialing platform helps financial services companies manage calling in a structured, compliant, and efficient way. It connects dialing, lead context, follow-ups, and call tracking into one workflow, so teams can reach prospects faster, stay organized, and protect trust as outreach scales.

Who Uses Financial Dialers (and Why)

- Sales teams: To respond quickly to new inquiries without losing context

- Appointment setters: To qualify leads and book consultations consistently

- Retention teams: To manage renewals, re-engagement, and client follow-ups

- Servicing teams: To handle account outreach while following call rules

- Financial services call centers: To run larger outbound programs with visibility and control

Key Benefits for Financial Teams

- Faster speed-to-lead: Contact prospects while interest is high using the right workflow

- Higher agent productivity: Reduce manual tasks and keep agents focused on conversations

- More consistent customer experience: Deliver informed, professional calls every time

- Stronger caller ID trust: Improve answer rates by managing reputation proactively

- Better performance visibility: See what’s working and optimize campaigns with confidence

- Compliance-focused workflows: Support calling rules without slowing teams down

What to Look for When Choosing a Financial Dialer

- Multiple dialing modes: Match the dialing approach to each campaign type

- CRM used during calls: Give agents full context before and during conversations

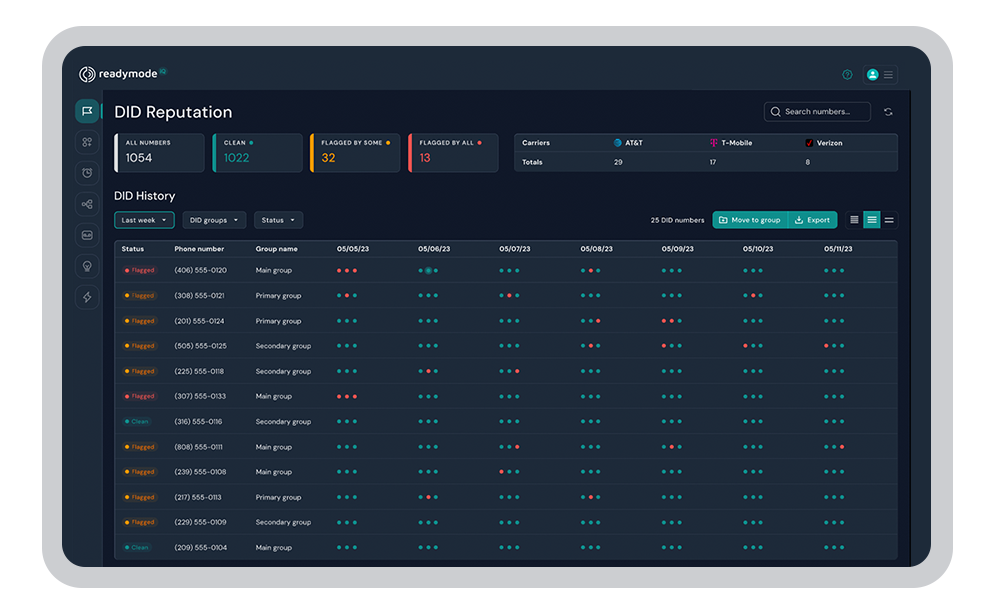

- Caller ID reputation tools: Monitor performance and support remediation early

- Built-in compliance support: Apply call rules naturally within daily workflows

- Efficient call logging: Capture outcomes and follow-ups without manual effort

- Transparent pricing: Avoid surprises as volume and campaigns scale

- Clear call quality: Sound professional on every call

Readymode has helped numerous financial services clients boost productivity and performance with integrated outbound calling solutions. Book your free demo now to see it in action.

Why Dialing Software Is a Must-Have for Financial Services

In financial services, dialing software allows teams to manage outbound calling in a structured, repeatable way across sales, follow-ups, and client outreach.

Instead of agents manually dialing numbers and tracking conversations in separate tools, a dialing system controls how calls are placed, paced, and logged, while keeping outreach aligned with defined call rules and messaging guidelines. It’s a unified system that not only streamlines the outreach process but also handles all customer data in a centralized environment.

This is critical because more than half of financial industry marketers say outdated or disconnected data is the biggest roadblock in their performance.

A platform like Readymode solves this by bringing dialing together with CRM, contact records, scripts, reporting, and compliance-support tools, so teams can operate from one place instead of managing disconnected systems.

Who Uses Dialing Software in the Financial Sector

Dialing software is used across multiple functions in financial services, not just traditional call centers. It supports teams focused on both acquisition and ongoing client relationships.

Here are a few examples of how different organizational functions use dialing software.

- Sales agents: Reach new prospects, follow up on inbound inquiries, and manage lead outreach without manually dialing or tracking callbacks

- Appointment setters: Qualify interest, book consultations, and ensure timely follow-ups with potential clients

- Retention teams: Handle renewals, policy updates, and re-engagement campaigns with existing clients

- Servicing teams: Conduct account outreach, payment reminders, or status updates while following defined call rules

- Financial services call centers: Manage larger outbound programs with structured workflows and performance visibility

Why Dialing Software Is Critical for Financial Services Companies

Financial services outbound calling carries higher stakes than most industries. Conversations often involve sensitive decisions, strict calling rules, and little tolerance for inconsistency. As a result, teams need systems that support speed, structure, and control at the same time.

Here are a few reasons outbound dialing software is so critical for financial services companies.

Reason #1: Faster Response Without Losing Control

Financial leads are often time-sensitive, but speed alone isn’t enough. Dialing software helps teams respond quickly while still following defined call rules, messaging guidelines, and workflows. This balance makes it easier to connect while interest is high, without rushing conversations or creating unnecessary risk.

Reason #2: Consistency Across Agents and Campaigns

Consistency matters when conversations involve money, trust, and regulation. Dialing software helps standardize how calls are placed, how scripts are used, and how follow-ups are handled. That consistency creates a more predictable experience for prospects and clients, regardless of which agent they speak with.

Reason #3: Compliance Support as Teams Scale

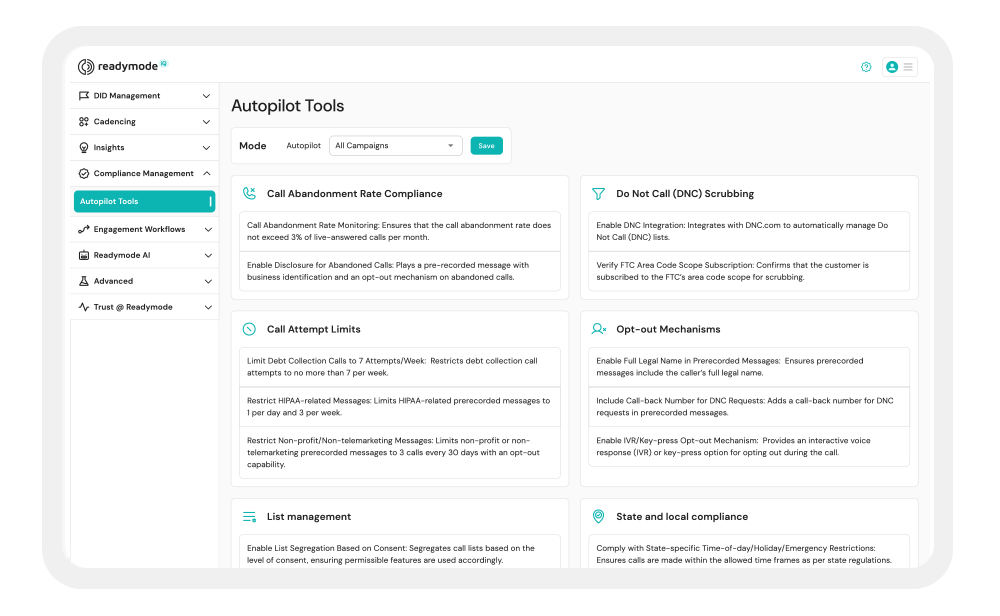

As financial teams grow, managing calling rules manually becomes more difficult. Dialing software supports compliance workflows by helping teams apply call timing rules, track attempts, and maintain call records. This reduces operational strain without shifting responsibility away from the organization using the platform.

How a Financial Dialer Can Benefit Your Team: 6 Proven Benefits

The real value of a financial dialer shows up in daily operations. From faster lead handling to more consistent outreach, the right system improves how teams work without adding risk or complexity.

Based on our experience working with many financial services clients, here are the most common benefits teams see from an outbound dialing solution.

Benefit #1: Faster Speed-to-Lead Through the Right Dialing Mode

A financial dialer closes the gap between lead arrival and first contact by controlling when and how calls go out, instead of leaving that process to manual effort.

For example, a lending team responding to inbound form fills may use preview dialing to review lead details before calling. Agents see the inquiry, confirm key information, and place the call immediately without switching tools or searching for the next record.

This approach fits conversations that require context and a consultative tone.

For follow-up or re-engagement campaigns, teams may use predictive dialing to keep agents connected to live conversations as availability opens up. The dialer manages pacing and routing in the background while respecting campaign rules and limits.

Readymode can apply dialing modes by campaign type, lead source, or outreach goal, allowing teams to respond quickly without forcing every call into the same workflow.

Benefit #2: Higher Agent Productivity Through Fewer Manual Tasks

Most financial services agents lose time managing lists, logging activity, setting follow-ups, and switching between systems to find context.

A financial dialer improves productivity by bringing those steps into a single, call-centered workflow.

Consider a debt relief or insurance team running daily outbound follow-ups. Without a dialer, agents finish a call, open a separate system to log notes, set a reminder for the next touch, and then search for the next contact. Those small steps repeat hundreds of times a day and quietly drain productive time.

With a financial dialer, agents log outcomes, capture notes, and trigger follow-ups as part of the call itself.

The system keeps every action tied to the contact record and applies next steps based on predefined rules. Agents move directly from one conversation to the next without stopping to manage admin work in between.

On platforms like Readymode, managers see where time goes across campaigns and where processes slow teams down. Agents keep a steady rhythm throughout the day, and productivity improves because fewer minutes disappear into manual tasks.

Benefit #3: More Consistent and Professional Customer Experience

A financial dialer improves the customer experience by giving teams a consistent structure for how calls start, flow, and conclude, while also helping agents personalize conversations so customers feel looked after.

For example, mortgage or insurance teams typically contact the same lead over time through multiple agents. Without shared context, one agent may repeat questions, overlook prior discussions, or approach the conversation without understanding where the last call ended. The prospect experiences friction instead of confidence.

In comparison, when dialing connects directly to CRM data, agents start each call with the full picture. Lead details, past conversations, call outcomes, and next steps appear in one place, allowing agents to pick up where the previous conversation left off. Dynamic scripts and prompts adjust based on that context, so calls feel informed and relevant without sounding scripted.

Readymode’s unified dialing and CRM features help teams deliver a more polished experience across campaigns and agents. Prospects hear consistent messaging, agents sound prepared, and conversations feel intentional rather than improvised.

Benefit #4: Stronger Caller ID Reputation and Trust Before the Conversation Begins

Modern prospects decide whether to answer based on how a call appears on their phone, long before they hear a voice. When numbers show up as unknown, mislabeled, or unrecognized, even legitimate financial outreach struggles to break through.

Caller ID reputation plays a major role here. It reflects how carriers and recipients perceive your phone numbers over time, based on call behavior and engagement patterns. If that reputation slips, answer rates follow.

A financial dialer helps teams bring caller ID reputation into the open. Instead of guessing which numbers perform well, teams gain visibility into answer rates and calling behavior at the number level. They can slow down outreach, adjust which numbers enter campaigns, and focus calls on their best-performing numbers.

With Readymode, caller ID reputation management becomes part of your day-to-day outbound operations. It gives you insight into performance trends, support for remediation when issues arise, and tools that help protect trust at scale.

Benefit #5: Better Visibility Into What’s Actually Working

Financial services teams often make outbound decisions with limited clarity. Managers review surface-level metrics, agents share anecdotal feedback, and campaign changes rely on instinct instead of evidence.

A financial dialer changes that by turning outbound activity into something teams can actually see, compare, and improve.

Take a lending or insurance team running multiple outreach campaigns at the same time. One campaign targets new inquiries, another focuses on follow-ups, and a third handles re-engagement. Without centralized visibility, managers struggle to understand which efforts generate real conversations and which ones quietly underperform.

With a financial dialer like Readymode, teams track outreach performance at the campaign, agent, and workflow level. Managers see how different call approaches perform, where conversations break down, and which patterns lead to better outcomes.

Benefit #6: Built-In Support for Compliance-Focused Workflows

In financial services, compliance failures usually come from process gaps, not intent. Teams grow, campaigns multiply, and agents juggle different rules across regions and contact types. When your compliance standards rely on spreadsheets or legacy knowledge, mistakes can creep in.

A financial dialer helps you build compliance considerations directly into how daily work happens. It lets teams embed call rules, attempt tracking, and contact status logic into the calling process itself. Agents follow the same guardrails on every call without stopping to interpret rules mid-workflow. Managers maintain oversight through clear records and reporting that reflect how outreach actually happens.

In Readymode, compliance considerations integrate into everyday workflows instead of being addressed after issues arise. This approach helps teams manage compliance more efficiently and consistently, while allowing agents to focus on delivering professional, well-run conversations.

7 Tips for Choosing the Best Financial Dialer

When you choose a dialing platform, problems usually don’t show up on day one. They show up weeks later when campaigns scale, agents rotate, or compliance questions come up.

These tips focus on what to verify before you commit, based on how financial teams actually operate.

Tip #1: Test Dialing Modes Against Real Campaigns

Don’t just confirm that a dialer supports preview, power, progressive, or predictive dialing. Ask the provider to show how each mode gets used in real scenarios.

For example, check whether you can:

- Use preview dialing when inbound calls require context and agent control.

- Switch to predictive dialing for follow-up or re-engagement campaigns

- Apply different dialing modes per campaign, not just per account

This matters because financial teams rarely run one type of outreach. If the platform forces you into a single dialing approach, agents either slow down or lose control.

Tip #2: Confirm Agents See Context Before the Call Starts

Ask to see exactly what appears on an agent’s screen before and during a call.

You want to verify that agents can:

- See lead details immediately

- Review past call outcomes and notes

- Understand what the next step should be without searching

If agents need to open another tool or guess where the last conversation ended, personalization breaks down fast, especially when multiple agents touch the same lead.

Tip #3: Ask How Caller ID Reputation Gets Managed Day to Day

Don’t accept vague answers about “number rotation” or “clean numbers.” Ask how the platform helps you protect your reputation over time.

Specifically, check whether the dialer:

- Shows which numbers perform best

- Flags drops in reputation

- Supports remediation instead of forcing number replacement

Caller ID reputation directly affects trust. If the platform only reacts after problems appear, you’ll feel the impact in the form of lower connect rates.

Tip #4: Walk Through a Compliance Scenario, Not a Feature List

Instead of reviewing compliance features on a slide, walk through a real example.

For instance, ask:

- What happens when a contact reaches a call attempt limit?

- How does the system handle different state calling windows?

- Where do agents see restrictions during live campaigns?

Compliance tools only help when they fit naturally into daily workflows. If agents have to manage everything manually, mistakes become inevitable as volume grows.

Tip #5. Watch How Agents Log Calls and Follow-Ups

Pay close attention to what agents do after a call ends.

A strong financial dialer should:

- Enable you to log outcomes

- Keep notes tied to the contact record

- Trigger follow-ups

If agents spend extra time logging activity or setting callbacks, productivity drops quietly across the team.

Tip #6: Verify Pricing With a Real Usage Scenario

Ask the provider to walk through a month of usage based on your expected activity.

Make sure you understand:

- What outbound minutes are included

- What triggers overage charges

- Which features cost extra later

Clear pricing protects you from scaling surprises, especially when campaign volume changes.

Tip #7: Listen to Call Quality in a Live Demo

Don’t rely on claims about voice quality. Ask to hear real calls.

Pay attention to:

- Clarity and consistency

- Delays or audio drops

- How professional agents sound to recipients

In financial services, poor call quality damages credibility immediately, even when scripts and processes are strong.

Tip #8: Validate How the CRM Actually Gets Used During Calls

Don’t just ask whether the dialer includes a CRM or integrates with one. Ask the provider to show how agents use CRM data during a live call.

Specifically, confirm that agents can:

- See lead source and key details before the call connects

- View past call notes and outcomes without switching screens

- Update notes and outcomes during or immediately after the call

In outbound teams, multiple agents often touch the same lead or account at various stages of the customer lifecycle. If CRM data lives outside the calling workflow, agents lose context, repeat questions, and weaken the customer experience.

A dialer should treat CRM data as part of the conversation, not as a separate system agents update later.

Why Readymode Is Trusted by the Financial Services Industry

Financial services teams don’t choose Readymode because it promises shortcuts. They choose us because the platform supports how regulated, trust-driven outreach actually works at scale.

Based on everything covered in this article, Readymode stands out because it helps financial teams:

- Manage outbound calling with structure, not guesswork: Readymode brings dialing, CRM context, reporting, and compliance-support workflows into one system, so teams don’t rely on disconnected tools or manual processes.

- Protect caller ID reputation proactively: With Readymode iQ, teams gain visibility into caller ID performance and access to tools like Autopilot and Managed Remediation that help address issues early, instead of reacting after answer rates drop.

- Match dialing behavior to real outreach needs: Teams can apply different dialing modes and call cadences based on campaign type, lead source, or outreach goal, rather than forcing every call into a single workflow.

- Reduce operational friction as teams grow: Features like Autopilot and structured workflows help teams maintain consistency across agents and campaigns without adding complexity or relying on legacy knowledge.

- Support compliance-focused operations without slowing down agents: Readymode includes features that fit compliance considerations into daily workflows, helping teams stay organized and consistent as outreach scales.

If your team needs dialing software built for real financial outreach, not generic sales shortcuts, Readymode offers a platform designed to support trust, consistency, and long-term performance.

Book a free demo today to experience our platform.

Frequently Asked Questions

How long does it take to onboard a financial team onto a dialer?

Onboarding time varies by team size and setup. Financial teams may start with a limited rollout, validate workflows, and expand once processes feel stable.

Can a financial dialer support both inbound and outbound workflows?

It depends on the dialer. Some platforms separate inbound and outbound workflows, while Readymode supports fully blended inbound and outbound calling so teams can respond to inquiries and continue outreach within the same system.

Do financial dialers work for small teams or solo operators?

Yes. Solo advisors and small teams use dialers to stay organized, manage follow-ups, and maintain consistency without manual tracking.

How does dialing software affect agent training and ramp-up time?

Dialing software shortens ramp-up by guiding agents through structured workflows, scripts, and call outcomes instead of leaving them to manage systems manually.

Can financial dialers integrate with existing systems?

Most financial dialers integrate with CRMs and business tools, allowing teams to improve calling workflows without replacing their core systems.

How do teams measure ROI from a financial dialer?

Teams usually look at trends like faster lead contact, improved connect rates, higher productive call time, and fewer operational errors.

Does using a dialer limit how agents handle conversations?

No. Agents control the conversation while the dialer provides structure to prevent missed steps and inconsistencies.

How do financial teams scale outbound calling without damaging trust?

Teams scale successfully by monitoring performance, managing caller ID reputation, and adjusting calling behavior instead of simply increasing volume.

Jawad Khan

Jawad is a seasoned content marketer and freelance technology writer featured in some of the world's leading digital marketing, e-commerce, and software related publications. As an expert contributor, Jawad has written for startups and enterprises, including Fortune 500 companies, across various tech verticals.